1. Purpose: The purpose of this document is to define the standard operating procedure for digital collections. NOCPL serves as a corporate business correspondent for several banks and NBFC. NOCPL is using digital mode to collect repayment amount, and for that NOCPL is collaborating with its technology partner, eSthenos Technology Private Limited. eSthenos has teamed up with a payment gateway partner.

2. Scope: The SOP is a standard operating procedure that defines the tasks involved in each step of the digital collection process.

3. Abbreviation:

- NOCPL: New Opportunity Consultancy Private Limited

- NBFC: Non-Banking Financial Company

- SOP: Standard Operating Procedure

4. Payment Modes: There are 3 available options for Cashless Collections:

- Payment via QR code

- Payment via PG link

- Payment via UPI ID

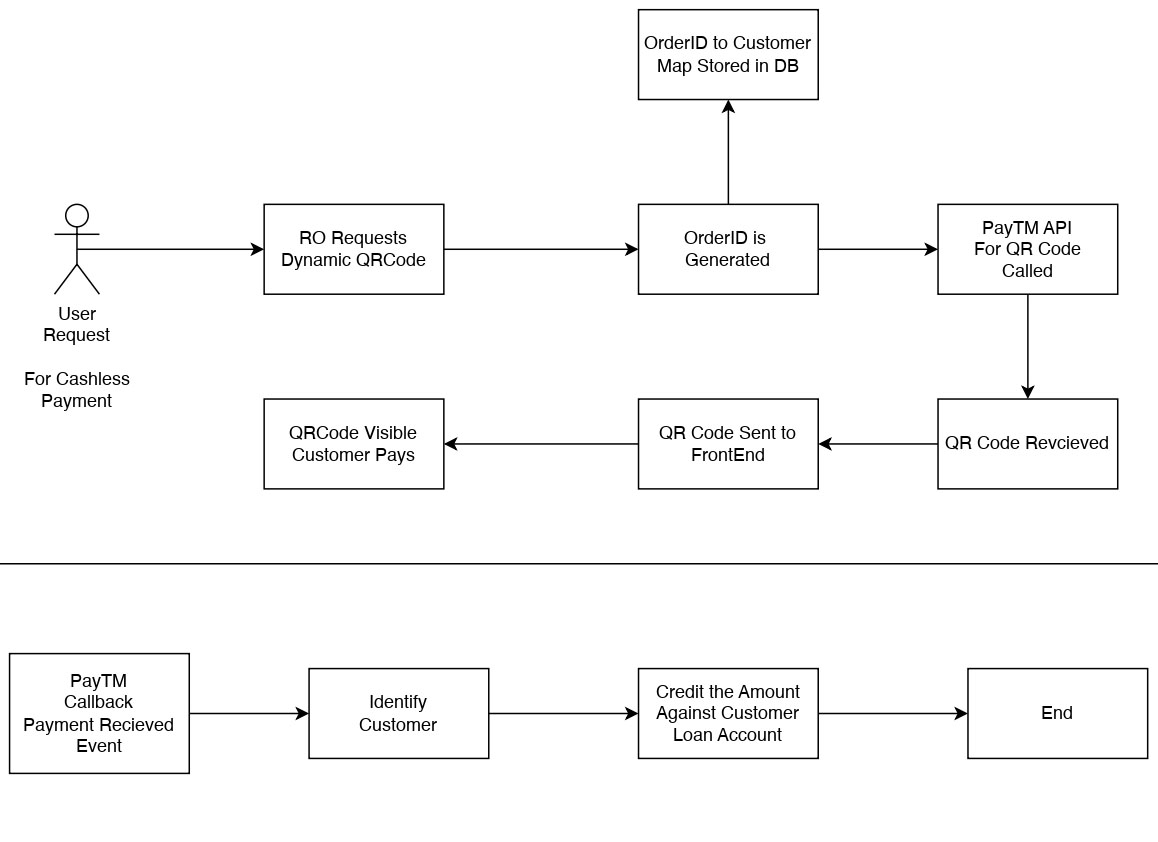

Payment via QR code

- Use the RO App to generate a QR code for the required transaction.

- Customers can scan the QR code using popular UPI applications such as Google Pay, PhonePe, Paytm, Amazon Pay, etc.

- Both the customer and RO will receive immediate confirmation of the cashless transaction.

- Please do not share the QR code with customers as it is dynamic. Reusing the same QR code in the future may cause issues.

Payment via PG link

- The RO needs to send an SMS to the customer's mobile phone.

- The customer will receive a link via SMS.

- By clicking on the link, the customer will be presented with different payment options, such as UPI, Net Banking, and Debit Card.

Payment via UPI ID

- The Requesting Officer (RO) must input the UPI ID of the customer.

- The Requesting Officer (RO) must input the UPI ID of the customer.

- Upon clicking the "pay" button, the payment will be executed.

5. Reconciliation Process

Whenever a customer pays using any of the aforementioned methods

- Digital collection entries are being verified by the Branch manager and finance manager twice.

- If any transaction is initiated but not processed will be settled on T+1 day based on Banking working hours.

- NOCPL pool account will be credited and Customer account debited.

- Collection confirmation will be done same day.

- A/c reconciled on daily as well as on monthly basis.

- The Refund and Cancellations Policy ensures that cashless refunds are processed post- reconciliation in cases of duplicate credit.

6. Workflow

- If amount is debited from customers Bank Account/card despite a failed transaction due to any reasons, the onus will be on your Bank/card/wallet Company to reverse the amount.

- In case customer have attempted to make an online payment of transaction more than once and New Opportunity Consultancy Private Ltd. have received the amount more than once, New Opportunity Consultancy Private Ltd. reserve the right to adjust it against OD EMI towards customer loan account.

- In case New Opportunity Consultancy Private Ltd. decided to refund the excess amount, it will be through electronic mode within 2 weeks of the claim acceptance.

- Customer will have to make an application or send a request to New Opportunity Consultancy Private Ltd. for refund along with the transaction number and original payment receipt if any generated at the time of making payments.

- Customer must claim any refund within 7 days of the payment.

- New Opportunity Consultancy Private Ltd. assumes no responsibility and shall incur no liability if it is unable to affect any Payment Instruction(s) on the Payment Date owing to any one or more of the following circumstances:

1. If the Payment Instruction(s) issued by customer is/are incomplete, inaccurate, and invalid and delayed.

2. If the Payment Account has insufficient funds/limits to cover for the amount as mentioned in the Payment Instruction(s).

3. If the funds available in the Payment Account are under any encumbrance or charge.

4. If your Bank refuses or delays to honor the Payment Instruction(s).

5. Circumstances beyond the control of Company (including, but not limited to, fire, flood, natural disasters, bank strikes, power failure, systems failure like computer or telephone lines breakdown due to an unforeseeable cause or interference from an outside force).

6. In case the payment is not affected for any reason, you will be intimated about the failed payment by an email by our Sales team.

- New Opportunity Consultancy Private Ltd. may in its sole discretion, for any or no reason may suspend or terminate use of online payment services from any payment gateway service provider.